Complete UK Company Financial Data

Including Hard-to-Find P&L Statements

Access balance sheets, profit & loss statements, revenue figures, asset valuations, and performance metrics for millions of UK companies - structured, searchable, and delivered as custom aggregated datasets, API feeds, or spreadsheets.

Company Financial Data Shouldn't Be This Hard to Use

Companies House provides public data, but it's buried in files requiring hours of extraction and validation

What You Need

- Revenue and profit/loss figures

- Asset valuations and liabilities

- Growth rates and financial ratios

- Multi-year trend analysis

- Complete balance sheet data

What You Actually Get

- Thousands of individual PDFs

- Inconsistent formatting

- Manual copy-pasting

- Hours of data cleaning

- No filtering or search

DataLedger Solution

- Structured datasets

- 50+ standardised fields

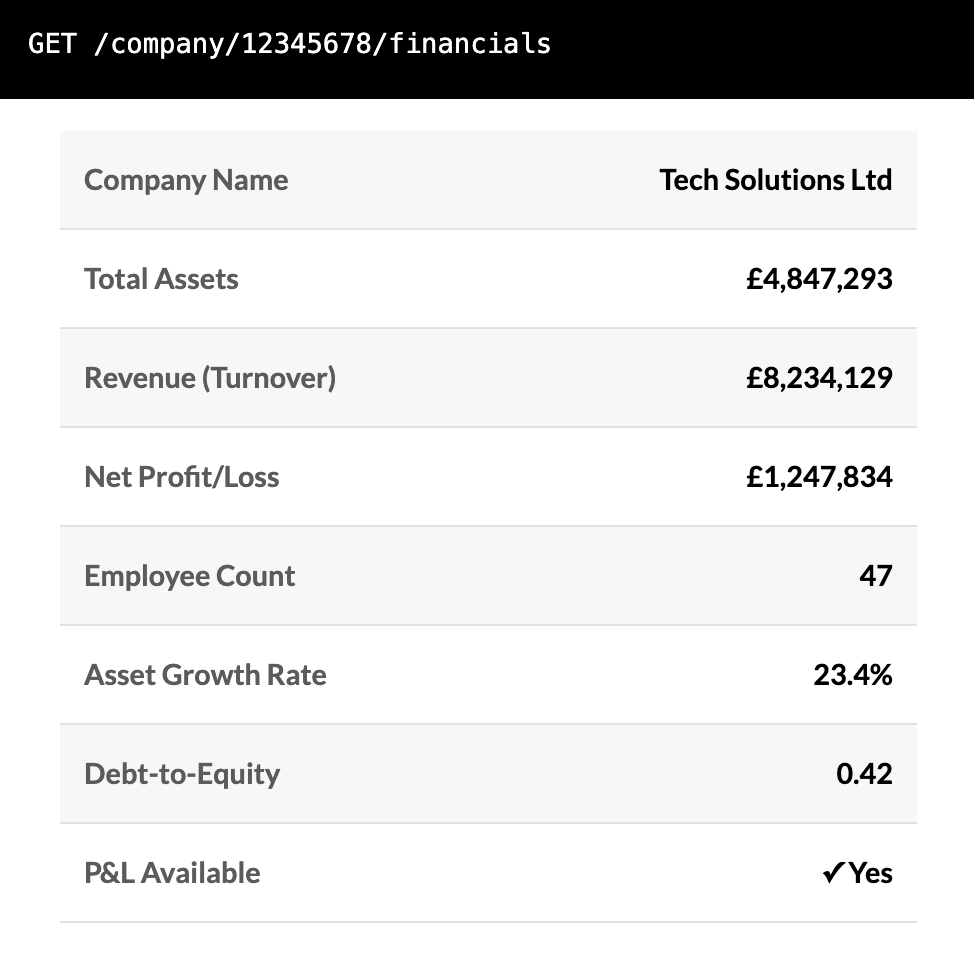

- Instant API access

- Analysis-ready data

- Custom filtering

What is DataLedger?

DataLedger transforms complex Companies House filings into structured, searchable datasets covering complete financial information for millions of UK companies.

Balance Sheets

Assets, liabilities, equity, cash, debtors, creditors

P&L Statements

Revenue, profit, expenses for 1.2m+ companies

Performance Metrics

Growth rates, debt ratios, custom calculations

Company Info

SIC codes, location, employees, directors

Delivered as custom datasets, API access, monthly reports, or through our AI-powered CHat interface.

Why DataLedger?

Complete Financial Data

Full balance sheets with 50+ standardised fields covering every asset and liability category. This isn't summary data - it's the complete financial picture.

Hard-to-Find P&L Access

Over 1.2 million UK companies file detailed profit and loss statements voluntarily. Access revenue, profit margins, operating costs, and wages.

Filter by Financial Metrics

Identify companies by assets, debt ratios, P&L availability, growth rates, employee counts, SIC codes, and location.

Flexible Delivery

Custom datasets, API access, monthly reports, CHat AI interface, or development support - delivered however you work.

Analysis-Ready Data

Consistently formatted, standardised fields, verified calculations, multi-year comparisons - no additional processing required.

More Affordable

Built on open Companies House data, priced for value. Enterprise-grade intelligence without legacy provider costs.

Companies House vs DataLedger

Companies House Challenges

Unstructured PDF filings

Each company's accounts in separate documents requiring manual download and extraction

No financial filtering

Can't search by assets, revenue, or profit without downloading thousands of filings

Manual data extraction

Hours spent copy-pasting from PDFs, reconciling formats, validating calculations

No P&L visibility

No way to identify which companies file detailed profit and loss statements

DataLedger Solution

Structured datasets

Complete balance sheets and P&L statements with 50+ standardised fields, ready to use

Advanced financial search

Filter by assets, debt ratios, P&L availability, growth rates, and custom thresholds

Analysis-ready data

Pre-calculated totals, ratios, and metrics with verified figures for immediate analysis

P&L filtering

Identify 1.2m+ companies with full P&L data including revenue and profit details

Common Use Cases

-

SME Credit Assessment Using Electronic Filing Data

Access structured balance sheet and P&L data from UK companies that file electronically with Companies House. DataLedger provides pre-calculated financial ratios and growth metrics for SME credit assessment and portfolio analysis.

Key use cases:

Debt ratio analysis: Use pre-calculated debt-to-equity and debt-to-asset ratios for credit risk assessment

Asset growth monitoring: Track year-on-year asset growth and net asset growth rates to identify expanding businesses

SME portfolio screening: Filter companies by equity levels, total assets, and liability thresholds for targeted lending

Financial health tracking: Monitor changes in key ratios across your client base using verified data

Available financial metrics:

Debt-to-equity ratios (current and previous year)

Debt-to-asset ratios (current and previous year)

Asset growth rates (year-on-year percentage change)

Net asset growth rates (year-on-year percentage change)

Complete balance sheet line items (when using detailed API calls)

P&L data including turnover and profit/loss (where companies file full accounts)

Data coverage: Electronic filings only - excludes large corporates that file on paper, but covers the growing SME and digitally-native business segment.

Technical implementation: REST API with financial ratio filters, bulk company screening, data quality indicators.

Progressive SME lenders are using structured electronic filing data for faster credit decisions. Still manually processing company accounts whilst competitors leverage structured data?

-

Skip Building Companies House Infrastructure - Use Our API Instead

Avoid the cost and complexity of building your own Companies House data pipeline. DataLedger provides ready-to-use structured financial data via API, eliminating months of development work and ongoing infrastructure costs.

Key benefits:

Avoid infrastructure costs: No need to build ETL pipelines, data storage, or processing systems for Companies House filings

Reduce engineering overhead: Skip months of development work parsing XBRL files and handling data quality issues

Enhanced product offering: Provide users with debt ratios, growth metrics, and financial analysis without building the calculation engine

Faster time-to-market: Integrate financial intelligence features in days, not months

Ongoing maintenance savings: No need to monitor Companies House API changes or handle data format updates

Implementation advantages:

On-demand data access: Call our API as needed rather than storing and maintaining your own database

Pre-calculated financial ratios: Get debt-to-equity, debt-to-asset, and growth rates without building calculation logic

Quality-assured data: Verified financial metrics (cVerified, pVerified) eliminate data validation work

Structured JSON responses: Clean, consistent data format perfect for AI/ML applications

Scalable pricing: Credit-based model grows with your usage without fixed infrastructure costs

Product enhancement opportunities:

Intelligent onboarding: Auto-populate company profiles reducing user data entry by 90%

AI-powered insights: Feed structured financial data into LLMs for custom report generation

Risk scoring features: Embed pre-calculated financial health indicators into your platform

Competitive analysis tools: Provide users with industry benchmarking using our sector data

Lead qualification enhancement: Enrich CRM records with growth indicators and financial stability scores

Technical implementation: RESTful API with comprehensive documentation and integration examples. Credit-based pricing eliminates upfront infrastructure investment.

Leading software platforms are focusing on their core product whilst leveraging DataLedger for financial intelligence. Still building Companies House infrastructure whilst competitors ship features faster?

-

SME Market Research & Industry Analysis

Access structured financial data for comprehensive market research and industry analysis. DataLedger provides detailed balance sheet and P&L data for evidence-based market insights and competitive intelligence.

Key use cases:

Market sizing and segmentation: Use financial filters to calculate total addressable market by revenue, assets, or geographic region

Industry trend analysis: Track sector performance using growth rates, debt ratios, and financial health indicators across SIC codes

Competitive benchmarking: Analyse competitor financial performance using balance sheet and P&L data

Economic impact assessment: Monitor SME sector health through asset growth and financial stability metrics

Research report development: Generate data-driven insights using comprehensive electronic filing database

Available analytical capabilities:

Financial health analysis using debt-to-equity and debt-to-asset ratios

Growth trend identification through asset growth and net asset growth rates

Sector performance comparison

Geographic market analysis using postcode and local authority data

Employee count analysis for workforce and operational insights

Data coverage: Electronic filing companies - comprehensive coverage of SMEs, growth companies, and digitally-native businesses.

Technical implementation: Bulk data export, advanced filtering APIs, statistical analysis capabilities, and geographic segmentation tools.

Leading market research firms are using structured electronic filing data for comprehensive industry analysis. Still relying on surveys and estimates whilst comprehensive financial data provides definitive market insights?

-

Advisory Services Using Structured Financial Data

DataLedger provides structured balance sheet and P&L analysis for modern advisory services.

Key use cases:

Growth company identification: Use asset growth rates to identify expanding businesses for advisory services

EIS qualifying company analysis: Filter by equity levels, employee counts, and growth indicators for EIS investment advice

Client benchmarking: Compare client debt-to-equity ratios and growth metrics against sector peers

Financial health monitoring: Track year-on-year balance sheet changes for existing advisory clients

Tech sector focus: Electronic filers include many SaaS, consulting, and digital businesses

Available analysis capabilities:

Pre-calculated debt-to-equity and debt-to-asset ratios for financial health assessment

Year-on-year asset growth analysis for expansion tracking

Net asset growth monitoring for wealth creation assessment

Complete balance sheet breakdown (fixed assets, current assets, liabilities)

P&L analysis including turnover and margins (where full accounts are filed)

Employee count data for operational analysis

Data coverage: Companies filing electronically - primarily SMEs, growth companies, and tech businesses rather than traditional large corporates.

Technical implementation: API filtering by growth rates, financial ratios, and balance sheet metrics with quality assurance indicators.

Modern advisory firms are building expertise in the growing SME sector through electronic filing intelligence. Focusing only on traditional large corporates whilst the digital economy expands?

-

Growth Company Recruitment Intelligence

Target companies with demonstrated financial growth using structured balance sheet metrics. DataLedger's electronic filing database captures dynamic businesses with expanding operations.

Key use cases:

Growth indicator targeting: Use asset growth rates to identify companies likely expanding their workforce

Financial stability screening: Filter prospects by debt-to-equity ratios to focus on financially stable potential clients

Expansion tracking: Monitor year-on-year asset growth and employee count changes for hiring predictions

Sector specialisation: Electronic filers include many tech, consulting, and digital businesses with active recruitment needs

Prospect qualification: Focus outreach on companies with positive financial indicators

Available growth indicators:

Year-on-year asset growth rates (companies expanding their asset base)

Net asset growth tracking (business expansion indicator)

Employee count filtering (direct hiring indicator)

Debt-to-equity analysis for financial stability assessment

Incorporation date filtering to identify new, potentially expanding businesses

SIC code targeting for sector-specific recruitment focus

Data coverage: Electronic filing companies only - excludes traditional large corporates but captures the dynamic SME and growth company segment.

Technical implementation: API filtering by employee ranges, growth rate thresholds, financial stability metrics, and incorporation dates.

Leading recruitment agencies are using financial growth indicators to identify hiring opportunities before competitors. Still cold-calling randomly whilst growth data shows exactly which companies are expanding?

-

Data-Driven Prospect Identification & Lead Qualification

Transform your business development approach using structured financial intelligence. DataLedger provides the data needed for targeted prospecting, lead scoring, and sales pipeline development.

Key use cases:

Prospect qualification: Filter potential clients by financial health indicators and growth metrics

Lead scoring and prioritisation: Rank prospects using debt-to-equity ratios, asset growth, and financial stability

Target market identification: Identify high-value prospects by revenue, assets, and employee count thresholds

Sales territory planning: Analyse prospect density and financial profiles across geographic regions

Pipeline development: Build targeted prospect lists using industry, size, and growth criteria

Available targeting capabilities:

Financial health scoring using pre-calculated debt and asset ratios

Growth company identification through asset growth and net asset growth rates

Size-based targeting by revenue, assets, and employee count

Geographic targeting using postcode and local authority filters

Industry-specific prospecting across detailed SIC code classifications

New business identification using incorporation date filtering

Data coverage: Electronic filing companies - ideal for targeting SMEs, growth companies, and tech businesses that often have higher technology adoption rates.

Technical implementation: Advanced search APIs, prospect list generation, growth indicator filtering, and CRM integration capabilities.

Top-performing business development teams are using financial intelligence for targeted prospecting. Still working from basic company directories whilst structured data reveals the best prospects?

How DataLedger Works

Tell us what you need

Book a demo or request a custom dataset describing your requirements

We build your dataset

We extract and structure the exact data you need from our database

You get ready data

Receive clean, structured financials ready for analysis or integration

Ongoing support

Additional fields, updates, and custom integrations as you need them

Frequently Asked Questions

-

DataLedger provides complete UK company financial data including balance sheets (total assets, current/fixed assets, intangible assets, property/plant/equipment, liabilities, creditors, provisions, equity), profit & loss statements (revenue, gross profit, operating profit, net profit, wages for 1.2m+ companies), performance metrics (growth rates, debt ratios, custom calculations), company information (SIC codes, location, employees, directors), and multi-year data for trend analysis.

-

DataLedger allows you to filter for companies that have P&L data available and by asset value ranges. For precise filtering like "companies with £2m-£10m revenue" or "firms with operating profit above £500k," we create custom datasets with exactly these parameters. Book a demo to discuss your specific filtering requirements.

-

Companies House provides raw, unstructured PDF filings. DataLedger transforms these into structured datasets with 50+ standardised financial fields per company, including complete balance sheets and P&L statements. We offer searchable/filterable data, multi-year comparisons, pre-calculated ratios, flexible delivery (spreadsheets, API, custom datasets), and development support.

-

A custom dataset is a bespoke spreadsheet or data file we create based on your specific criteria. You describe what you need, we extract and structure the data with all relevant financial fields, and deliver it as Excel, CSV, or your preferred format - typically within 24-48 hours.

-

Pricing depends on your requirements. Custom datasets typically start at £200-£500+ depending on complexity and data volume. API access is priced based on usage volume and support needs. Enterprise solutions have custom pricing for high-volume integrations and development support. Book a demo to discuss specific pricing for your use case.

-

Yes, our paid plans include a licence for commercial reuse of the data.

-

All users have a rate limit of 50,000 tokens per hour, calculated on a rolling basis. If you exceed this limit, you'll receive error responses and need to wait for the rate limit to reset. This ensures optimal performance for everyone.

Get Started With DataLedger Today

For Enterprises & Ongoing Needs

Discuss API integration, development support, and custom solutions for your organisation.

Unlimited API calls available

Custom development assistance

Dedicated implementation support

Priority access to new features

For Individuals & One-Off Needs

Get a custom dataset built to your exact specifications within 24-48 hours.

Bespoke dataset creation

Any industry or geography

Custom financial filters

Excel or CSV delivery